CV Investment Banker

Breaking into the world of Investment Banking requires more than just strong financial knowledge — it demands a sharp, professional presentation. Your CV Investment Banker is your first opportunity to showcase your analytical skills, deal experience, and strategic thinking. Recruiters look for candidates with a strong educational background, quantitative abilities, and a proven ability to work under pressure. A well-structured CV can highlight your financial modeling, MandA transactions, and client management experience. Whether you’re an entry-level applicant or a seasoned banker, crafting a clear, compelling Investment Banking CV is essential to stand out in a highly competitive field.

Results-driven Investment Banker with over 5 years of experience in mergers and acquisitions, equity financing, and strategic advisory services. Proven track record in executing high-profile deals and delivering strong returns for corporate clients. Skilled in financial modeling, valuation techniques, and managing investor relationships. Adept at working in fast-paced, high-pressure environments.

Professional Experience

Associate Investment Banker

Goldman Sachs, New York, NY

[Date]

- Led financial modeling for deals worth over $500 million in technology and healthcare sectors.

- Participated in due diligence, valuation analysis, and the preparation of client presentations.

- Coordinated with legal and compliance teams to ensure smooth transaction execution.

- Developed pitchbooks and investment memoranda for private equity and corporate clients.

Analyst – Investment Banking Division

J.P. Morgan, New York, NY

[Date]

- Supported senior bankers in executing M&A, IPO, and leveraged finance deals.

- Built and maintained complex financial models, including DCF and LBOs.

- Conducted sector analysis and client research to identify investment opportunities.

- Presented findings to internal stakeholders and assisted in client meetings.

Education

Master of Science in Finance

Columbia Business School, New York, NY

[Year of Graduation]

Bachelor of Business Administration

University of Michigan, Ann Arbor, MI

[Year of Certification]

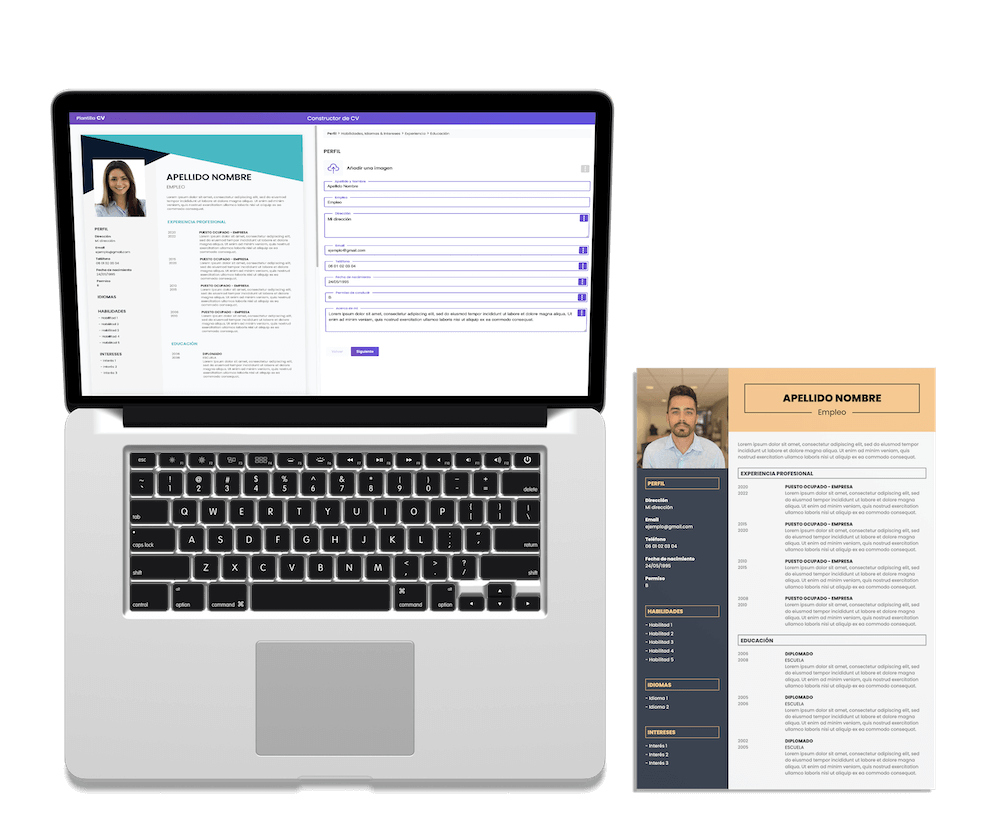

Want to see more CV templates?

The different parts of the Investment Banker CV

Creating an effective Investment Banker CV requires careful attention to several key sections that highlight your expertise, achievements, and professional persona. Each part of the CV serves a specific purpose in demonstrating why you are the right fit for a demanding role in investment banking. From showcasing your analytical skills to detailing your professional experience, a well-structured CV helps recruiters quickly grasp your qualifications. A strong Investment Banker CV typically includes the about section, skills, languages, interests, professional experience, and education. Understanding how to craft and optimize each section is crucial to stand out in the highly competitive financial industry.

The about section

The about section or professional summary is the first opportunity to introduce yourself in a concise and compelling way. It should briefly summarize your career highlights, core competencies, and what sets you apart as an investment banker. This section allows recruiters to understand your career trajectory and your key strengths at a glance.

A good about section emphasizes your experience in financial modeling, deal execution, and client relationship management while reflecting your motivation and professional attitude.

Example:

«Results-oriented Investment Banker with over 6 years of experience specializing in mergers and acquisitions, equity capital markets, and strategic advisory services. Proven expertise in building complex financial models, leading cross-functional teams, and delivering tailored financial solutions that drive business growth. Adept at navigating fast-paced environments and managing high-profile transactions with precision and professionalism.»

This example immediately informs the reader about the candidate’s experience level and core skills, setting the tone for the rest of the CV.

The skills section

The skills section is critical for an Investment Banker CV because it lists the technical and soft skills necessary to excel in the role. Investment banking requires a blend of quantitative abilities, analytical thinking, and communication skills. The skills you highlight here should align with the job description and showcase your proficiency in financial tools, software, and interpersonal capabilities.

Key skills often include financial modeling, valuation techniques such as Discounted Cash Flow (DCF) and Leveraged Buyouts (LBO), market analysis, and negotiation skills. It is also beneficial to mention familiarity with software like Excel, Bloomberg, Capital IQ, and PowerPoint.

Example:

- Advanced financial modeling and valuation expertise (DCF, LBO, Comparable Company Analysis)

- Strong knowledge of M/A transactions and equity/debt financing

- Proficient in Bloomberg Terminal, Capital IQ, and Microsoft Excel

- Excellent communication and presentation skills

- Ability to work effectively in high-pressure, fast-paced environments

Including such a detailed list ensures your technical competencies and personal strengthsare clear, increasing your chances of passing automated resume filters and impressing hiring managers.

The languages section

In today’s globalized financial markets, language skills are a significant advantage for an investment banker. Many deals involve international clients, so proficiency in multiple languages can differentiate you from other candidates. The languages section should clearly state your level of fluency, whether native, fluent, or conversational.

Highlighting languages beyond English shows your cultural awareness and ability to navigate diverse business environments, which is essential in multinational investment banking firms.

Example:

- English: Native proficiency

- Mandarin: Professional working proficiency

- French: Intermediate conversational skills

By listing languagesclearly and honestly, you give recruiters insight into your communication abilities across different markets.

The interests section

While not always mandatory, the interests section adds a personal touch to your CV and can make you memorable to recruiters. The key is to mention interests that relate to skills useful in investment banking or that show well-roundedness and discipline.

Examples of relevant interests include strategic games like chess, marathon running (which demonstrates endurance and dedication), or financial blogging. Such interests can indicate qualities like strategic thinking, perseverance, and passion for finance.

Example:

- Competitive chess player, honing strategic and analytical skills

- Marathon runner, demonstrating commitment and stamina

- Contributor to financial market analysis blogs, staying updated on industry trends

Including interests like these humanizes you and may spark conversations during interviews.

The professional experience section

The professional experience section is the core of your Investment Banker CV. It should document your relevant roles, achievements, and responsibilities in chronological order, starting with the most recent. This section provides evidence of your ability to handle complex financial transactions and deliver results.

For each role, describe your key contributions, such as leading deal execution, conducting valuations, preparing pitchbooks, and managing client relationships. Use quantifiable achievements where possible to add impact, such as the value of deals you worked on or percentage growth achieved.

Example:

Associate Investment Banker

Goldman Sachs, New York, NY

March 2020 – Present

- Led due diligence and valuation for M&A transactions worth over $750 million in the technology and healthcare sectors.

- Developed detailed financial models (DCF, LBO) to support client investment decisions.

- Coordinated cross-functional teams to streamline deal processes and ensure timely execution.

- Created and delivered presentations to C-level executives and investors.

By showcasing your experience in this manner, you demonstrate a strong track record of success and relevant expertise.

The education section

The education section validates your academic background, which is often a prerequisite in the finance sector. Most investment bankers hold degrees in finance, economics, business administration, or related fields. Listing your degrees along with relevant coursework or honors helps position you as a well-prepared candidate.

Include the institution name, degree obtained, dates attended, and any special distinctions or leadership roles. If you have completed certifications like the CFA (Chartered Financial Analyst) or CPA, include these as well.

Example:

Master of Finance

Columbia Business School, New York, NY

2015 – 2017

- Concentration in Investment Banking and Corporate Finance

- Graduated with Honors

- Finance Club President

This section shows recruiters that you possess a solid theoretical foundation and are dedicated to your professional development.

Should I include a professional summary or objective statement?

Including a professional summary or objective statement at the top of your investment banker CV can significantly improve your chances of catching a recruiter’s attention. A professional summary briefly highlights your key skills, experience, and career achievements, tailored to the specific job you are applying for. On the other hand, an objective statement focuses more on your career goals and what you aim to contribute to the company. For experienced bankers, a summary is usually more effective, while entry-level candidates might benefit from a clear and concise objective to showcase ambition and direction.

How do I explain employment gaps on my CV as an investment banker?

When addressing employment gaps on your investment banker CV, honesty and transparency are crucial. Briefly explain the reason for the gap, whether it was due to personal development, further education, or market conditions. Use this space to emphasize any productive activities during the gap, such as freelance consulting, professional certifications, or volunteer work relevant to finance. Avoid leaving unexplained blanks, as recruiters might question your commitment. Frame the gap as a time of growth or skill acquisition that ultimately strengthened your ability to contribute to future roles.

What skills are most important to emphasize on an investment banker CV?

Your investment banker CV should focus on both technical and soft skills. Highlight financial modeling, valuation techniques, and data analysis as core competencies. Proficiency in Excel, Bloomberg Terminal, and financial software like Capital IQ or FactSet is essential. Additionally, emphasize your attention to detail, communication skills, and ability to work under high-pressure environments. Demonstrating strong problem-solving and team collaboration skills is equally important. Tailoring these skills to match the job description will show recruiters that you have the expertise and mindset required for success in investment banking.

How do I format my CV for online applications and ATS systems?

To ensure your investment banker CV passes Applicant Tracking Systems (ATS), use a clean, simple layout without complex tables or graphics that can confuse the software. Stick to standard fonts like Arial or Times New Roman and use clear section headings such as “Experience,” “Education,” and “Skills.” Incorporate relevant keywords from the job description throughout your CV, especially in your skills and experience sections. Save and submit your CV in PDF or Word format, depending on the employer’s preference. Avoid excessive use of abbreviations or jargon that the ATS might not recognize

Create your CV now

Choose a template CV and create your own online